J.D. Power is back with the results of yet another annual survey – India Sales Satisfaction Index (Mass Market) Study. The 2019 chapter marks the twentieth year of the study’s existence. As the name suggests, it examines six factors which contribute to overall customer satisfaction in the new vehicle purchase (mass market) experience. In order of importance and rounded-off to the nearest whole number, they are – dealership facility (22 per cent); delivery process (21 per cent); dealer sales consultant (21 per cent); paperwork completion (17 per cent); working out the deal (15 per cent); and dealership website (3 per cent).

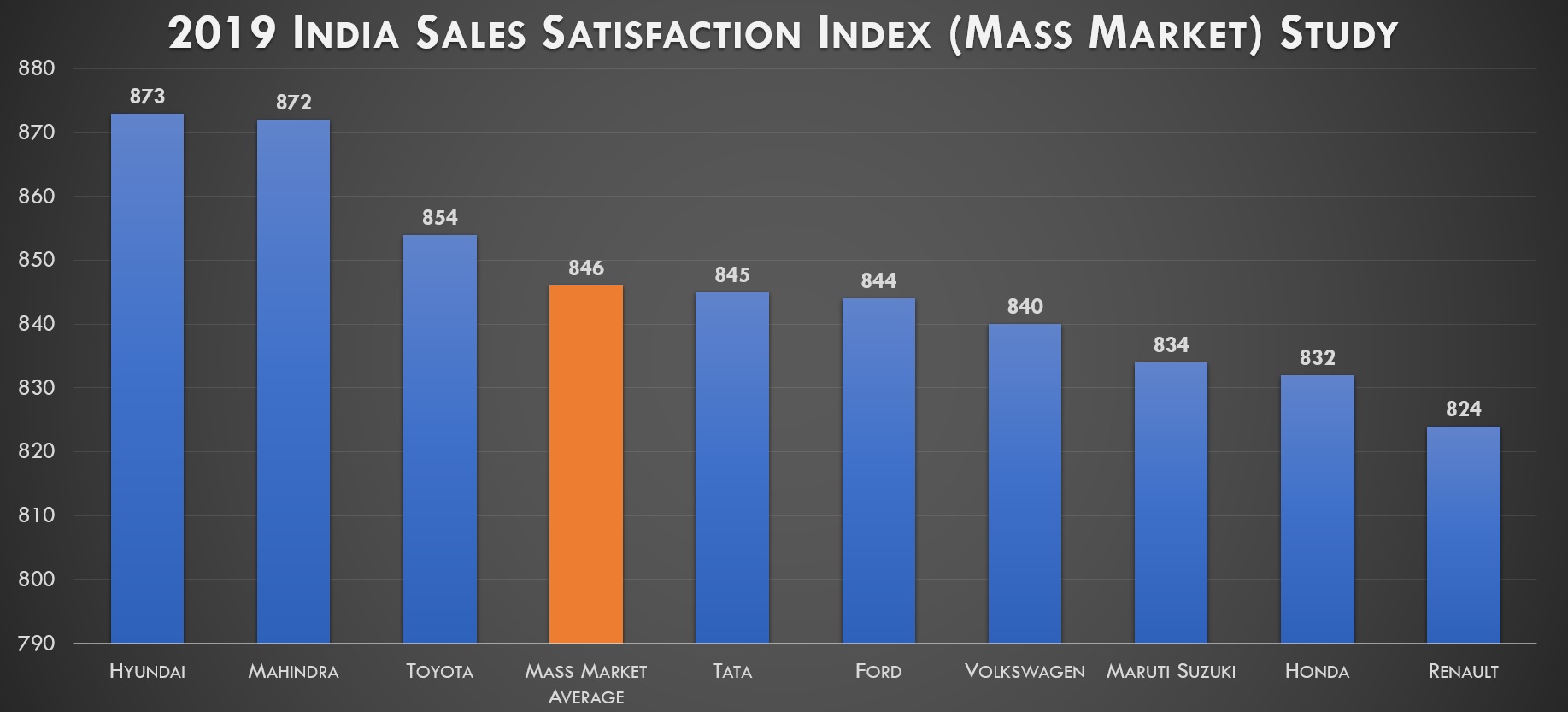

Just like it topped J.D. Power’s Customer Service Study earlier this year, Hyundai Motor India has taken pole position in the sales satisfaction study as well. With 873 points out of a possible 1,000, the South Korean carmaker beat second-placed Mahindra by one and third-placed Toyota by 19 points. The overall sales satisfaction for the mass market segment in 2019 is 846, which is 4 points up from last year. As far as the sample size goes, J.D. Power captured responses from 6,583 new-vehicle owners who purchased their’s between September 2018 and June 2019. Here’s how carmakers fared:

Such studies always capture some fascinating observations, and this one is no exception.

– Customers with a monthly income of at least Rs 75,000 account for 33 per cent of all buyers in 2019. That’s up from 18 per cent in 2017.

– Because of the increased income, buyers are now able to cover the cost of their car with fewer months of income than before (15 months in 2019 vs 18 months in 2017).

– Buyers now place more emphasis on vehicle styling, both exterior and interior, when deciding on a model (increased nine percentage points from last year).

– Other factors such as performance and reliability (both up seven percentage points), as well as technology (up by five percentage points), also play vital roles in shortlisting a car.

– Aspects such as the price of the vehicle/monthly instalments and the ability to obtain financing have declined in importance (both down by four percentage points).

– Prices of cars now are 5 per cent higher than in 2018 and 11 per cent higher than in 2017. The most evident increase is in the small car segment (9 per cent higher than in 2017). The SUV segment, on the other hand, has witnessed a relatively lower increase of 3 per cent than in 2017.

– Dealers are not as pushy as before (15 per cent in 2019 vs 22 per cent in 2018). A similar trend pops up for the following two parameters – attempting to change promised prices (11 per cent vs 17 per cent) and difficulty getting a “straight answer” on price (14 per cent vs 18 per cent).

– The time between booking a vehicle and taking delivery has dropped to 10 days from 12 days last year.

– More vehicles arrived without problems (92 per cent vs 83 per cent in 2018), such as scratches, dents, missing features and others.