EV Push: GST Slashed From 12 To 5 Per Cent

Up until now, the only real push towards electric mobility was seen in the form of Faster Adoption & Manufacturing of Hybrid and Electric vehicles (FAME) scheme. The second phase came into effect from April this year. Now, however, we have more encouraging developments. The Union Budget of 2019, which brought an increase in price for petrol and diesel fuels, has taken EVs (electric vehicles) from the 12 per cent Goods and Services Tax (GST) slab and placed it under the 5 per cent category.

Toyota EV Logo

What that means is that the costs for zero-emission vehicles will come down. And, to bolster the cause further, custom duty on certain EV parts will be reduced. To make EVs even more enticing for consumers, the centre will give additional income tax deduction of Rs 1.5 lakh on the interest paid on loans taken to buy EVs. This means the total subvention available from the government for purchasing an EV is now up to Rs 2.5 lakh.

The country’s Finance Minister, Nirmala Sitharaman, said that the government wants India to become a global hub for EV manufacturing. Not just that, it also wants to attract investments from all over the world to locally manufacture solar storage batteries and set up a widespread charging infrastructure. For the latter, two of India’s main highway corridors are being readied to establish a total of eighteen charging stations.

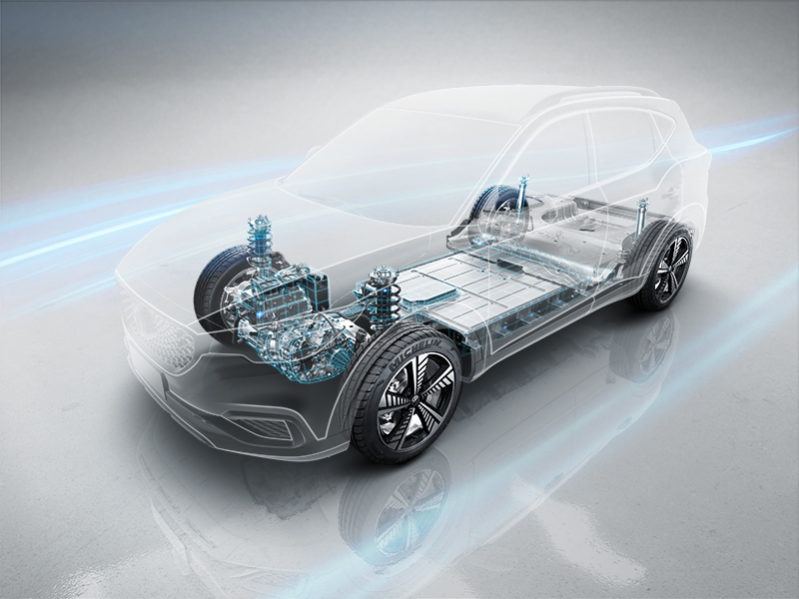

MG eZS Powertrain

These developments will surely encourage consumers as well as OEMs to invest in electric mobility. Presently, the choice for EVs, especially in the personal car space, is almost none. That being said, mainstream carmakers like MG Motor, Hyundai, Mahindra, Tata, Toyota and Maruti Suzuki will be launching their versions of electric cars in months to come.